Ready to connect with a solar installer?

Contact us to get connected with a solar installer near you.

In the ongoing fight against the climate crisis, clean energy tax credits, such as the Investment Tax Credit (ITC), play a crucial role. These tax credits pack a big punch for homeowners looking to adopt cleaner and more sustainable energy solutions, including solar power and solar power plus storage systems.

Part of President Biden’s Inflation Reduction Act (IRA), the ITC, along with other tax incentives, holds the potential to steer the United States toward a cleaner, more sustainable energy future. Initial estimates foresaw the IRA contributing at least $370 billion to climate action, with $257 billion earmarked for tax credits. However, recent reassessments suggest that these projections might be conservative, hinting at the possibility of these investments being three times more substantial. For those who choose to take advantage of the ITC, the sky is the limit, as there are no value or lifetime caps.

The ITC facilitates new investment in clean energy installations by allowing individuals and corporations to reduce their tax liability by 30% of the investment's cost. This reduction is dollar-for-dollar; for example, claiming a $1,000 federal tax credit would reduce federal income taxes due by $1,000. If the credit exceeds tax liability for the year, the unused portion can be “rolled over” to future years so long as the credit remains in effect. A diverse range of projects are eligible for the ITC, including manufacturing, energy efficiency, and renewable energy initiatives (such as solar power systems).

To qualify for the baseline 30% credit, the project must meet the following requirements for labor standards:

ITC Eligibility Criteria: Who Can Benefit?

The beauty of the ITC lies in its accessibility. Unlike some incentives that cater exclusively to corporations, the ITC can be claimed by a wide range of entities, including individuals, nonprofits, and households. For homeowners, the ITC opens doors to reducing tax liability, making solar energy not only an environmentally conscious choice but a financially savvy one as well.

The ITC can be claimed for improvements to a primary residence, regardless of whether the applicant rents or owns. It's important to note that landlords or other property owners who do not reside in the home are ineligible to claim the credit.

Eligibility Criteria: How to Leverage the ITC

The Investment Tax Credit and its Bonus Credits are a game changer for the economics of solar and solar+storage projects. Many projects are eligible for a baseline credit of at least 30% of the total solar or solar+storage project costs. By incorporating and stacking one or more bonus credits, some projects may even qualify for up to 70% of eligible project costs.

To take advantage of the ITC, homeowners must ensure their solar equipment meets specific criteria:

Meeting these criteria lays the foundation for a successful claim of the ITC, ensuring that an investment in solar energy is not only environmentally conscious but also financially rewarding. Note that the credit must be claimed the tax year when the equipment is installed, not the year of purchase. Always check the latest IRS guidelines or consult with a tax professional for the most current information.

In addition to the baseline 30% credit, the ITC also offers four bonus credits that can significantly enhance the financial benefits of your solar project. Stacking these bonus credits on top of the base credit allows for coverage of up to 70% of eligible project costs.

The Four Bonus Credits:

If met, this increases the value of the ITC from 6% of eligible project costs to 30%.

Offers between a 2% and 10% bonus credit for projects that meet domestic manufacturing requirements.

Offers 10% for projects located within an “energy community,” which is defined as:

Offers a credit of between 10 and 20% of eligible project costs for qualified solar and wind projects built in or that benefit low-income communities.

All four bonus credits are eligible for direct pay, meaning that non-taxpayers, such as local governments, government agencies, and nonprofit organizations, can receive their value as a cash payment.

Understanding and strategically leveraging these bonus credits can make a substantial difference in the overall economics of your solar and solar+storage projects.

Solar energy incentives change frequently and will not be available indefinitely. Solar incentives are developed in order to "incentivize" early adoption. In other words, the installation of a solar power system should be included in planning sooner rather than later for homeowners who want to lower their upfront solar equipment costs, increase their energy savings, lower their operating expenses, and reduce their carbon footprint.

Tax credits, including the ITC, are powerful tools not only to reduce tax liability but also to stimulate investment in clean energy. While they may pose certain challenges in terms of eligibility and application, the potential financial benefits make them a compelling option for those considering solar projects.

If you are thinking about investing in a solar project that might qualify for the ITC, you should consult with a tax professional to ensure you are eligible and understand the specific rules and requirements. They can provide personalized guidance, ensuring that you navigate the complex tax regulations with confidence and maximize the financial advantages available.

Installing a solar power system and taking advantage of the ITC is not just a wise financial move; it's a strategic and sustainable investment in the future.

Contact us to get connected with a solar installer near you.

Articles:

https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics

https://www.cleanegroup.org/how-to-make-the-most-of-the-investment-tax-credit-applying-for-bonus-credits/

https://www.carboncollective.co/sustainable-investing/investment-tax-credit-itc

https://www.thehartford.com/business-insurance/strategy/business-tax-credits/investment-tax-credits

https://impactcp.org/insights/what-are-investment-tax-credits/

https://turbotax.intuit.com/tax-tips/going-green/federal-tax-credit-for-solar-energy/L7s9ZiB4D

https://www.marketwatch.com/guides/solar/federal-solar-tax-credits/

IRS:

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

https://www.irs.gov/pub/taxpros/fs-2022-40.pdf

https://www.evergreenaction.com/blog/what-are-clean-energy-tax-credits

Find Policies and Incentives by State:

A question often asked by installers and homeowners alike is, “How do I maximize the performance of my batteries?”

First and foremost, the batteries require installation as per the environment and operating parameters specified in the battery manual. Secondly, the power conversion equipment, batteries, and load must all be sized to match. The cables and connectors, often overlooked when setting up the system, are vital. And lastly, the batteries must communicate the battery status to the power conversion equipment in a closed-loop configuration to maximize charging efficiency and the life of the battery.

The installation location is very important for the battery to operate at its full potential.

Installing the batteries in a location that meets the documented environmental specifications is mandatory. But further to that, the battery runs more efficiently if used at moderate temperatures and not in the extremes of any of the temperature ranges. Operating batteries at an ambient temperature between 15 and 20 oC (59 to 68 oF) is optimal.

Other environmental considerations include the climate of the environment. Add dehumidifiers and fans to keep the batteries dry in wet, humid environments. Add heating in extremely cold environments. Add cooling in extremely hot environments. Keep the batteries and equipment clean and free of dust and debris.

Considering the increased frequency of weather events, evaluate how that could impact the batteries. Add appropriate drainage and ensure batteries are installed well above the ground to protect batteries from flood water. To protect batteries from tremors and potential earthquakes, install them on a solid surface and attach wall straps to secure the batteries to a frame.

The placement of batteries can also influence performance, as well as safety. The location should include good airflow with space between the batteries, walls, and ceiling. Also, batteries should be installed away from living quarters and away from any sources of heat.

The power conversion equipment has charge current and output current ratings. There should be enough batteries to handle the charge current, as well as handle the load requirements of the system, whether it be the whole home, specific appliances, or other loads.

The first thing to calculate is the load requirement. Appliances have energy guidelines. If possible, also identify their peak loads. Lightbulbs define their energy usage in watts (per hour). And if you use an EV charger, review its energy rate information. Total all these values to get the load requirement in the home.

Configure enough batteries to handle the power converted by inverter-chargers, and configure enough batteries to handle the load, whether it be the whole home, specific appliances, or other loads.

The installation should also take into account the cables and connectors. Whenever possible, use manufacturer-recommended and UL-rated cables and connectors. The cables and connectors should be of high quality and capable of handling the voltage and current generated by the power conversion equipment and batteries. Without correctly sized cables and connectors, the system can overheat.

The length of the cables between all the components in the Energy Storage System (ESS) should be as short as possible by locating the batteries close to the power conversion equipment. You can minimize the resistance, voltage drop, and other electrical issues with good, short cables and secure connectors.

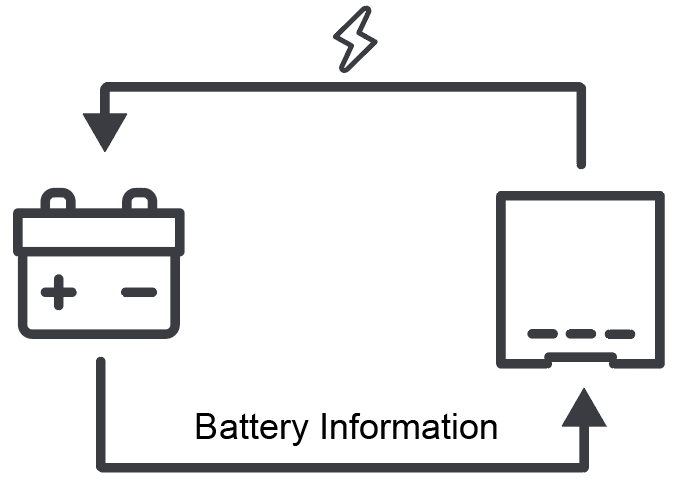

Perhaps the most important component that enables Lithium batteries to run efficiently is closed-loop communication between the Battery Management System (BMS) and the power conversion equipment. By using closed-loop communication, the power conversion equipment adjusts the energy delivered to batteries depending on the battery's current State of Charge (SOC), cell temperature, and voltage.

There are many things installers and homeowners can do to maximize the performance of their batteries. First and foremost, install the batteries as per the environment and operating parameters specified in the battery manual. Secondly, the power conversion equipment, batteries, and load must all be sized to match. The cables and connectors must also be sized for the system. And lastly, the batteries must pass battery information, such as the battery SOC, temperature, and voltage, to the power conversion equipment to maximize charging efficiency and maximize the life of the battery.