Remote Cabin in Northern Utah

Installer: Intermountain Wind and Solar

Project Overview

Set against the green farmland of Lancaster County, Springville Foods is now primarily powered by the sun and batteries. This image shows the store, PV array, and surrounding agricultural facilities that rely on resilient power.

Springville Foods is a full-service grocery store nestled in the heart of Pennsylvania Dutch country, serving a loyal base of Amish and rural customers since 2004. Like many businesses in remote or underserved areas, it historically depended on diesel generators to meet its energy needs, operating both a 100 kW primary and a 50 kW secondary generator. These units provided power to essential loads such as commercial coolers, freezers, HVAC, lighting, and point-of-sale systems. While reliable in principle, the diesel solution posed challenges: high fuel costs, regular maintenance requirements, and occasional load management limitations during peak usage.

In pursuit of sustainability, energy independence, and lower operating costs, the owners of Springville Foods partnered with CB Solar and Zonna Energy to transition to a modern hybrid power solution. The result is a clean, quiet, and efficient off-grid system powered primarily by solar and batteries, with diesel used only as a secondary backup.

Project Overview

CB Solar, Zonna, and Discover work on live commissioning of the AES 210HV cabinets and Sol-Ark 60K-3P inverters. Final performance checks on communication and closed-loop performance ensure a smooth transition to energy independence.

Discover’s AES 210HV high-voltage battery storage platform is the backbone of the new system. Two pre-assembled outdoor cabinets were installed, providing a total of 418 kWh of usable energy storage. These cabinets integrate seamlessly with two Sol-Ark 60K-3P commercial hybrid inverters, which deliver a combined 120 kW of continuous power output. A 75 kW photovoltaic array supplies renewable energy directly to the inverters and batteries.

The AES 210HV includes advanced thermal management via integrated liquid cooling and heating, built-in fire safety, thermal suppression (aerosol-based), and deflagration ventilation to meet UL9540 safety standards. Communication between the batteries and inverters is managed through the LYNK II Gateway, enabling real-time closed-loop control for optimized charging and discharging.

Key technical features of the system include:

- Storage Capacity: 418 kWh usable (two AES 210HV cabinets)

- Inverter Power: 120 kW continuous (two Sol-Ark 60K-3P inverters)

- Solar Capacity: 75 kW

- Grid Independence: Full off-grid operation with diesel generators now used only as backup

- Load Profile: Commercial refrigeration, HVAC, lighting, registers, and office equipment

Operational Benefits and Lessons for Off-Grid Designers

Two AES 210HV cabinets provide 418 kWh of high-voltage, liquid-cooled lithium storage. Prewired Sol-Ark inverters are wall-mounted next to the store's electrical room, allowing direct AC and DC integration.

.

Today, Springville Foods operates primarily on solar energy and battery power, with diesel backup used sparingly during extended cloudy periods or high-load events. The transition has delivered immediate benefits:

- Fuel savings: Dramatic reduction in diesel consumption and generator runtime

- Maintenance reduction: Fewer mechanical hours and service events for generator upkeep

- Quiet operation: A quieter, cleaner environment for staff and customers

- Load flexibility: Smoother delivery of power to compressors and HVAC systems, especially during peak load transitions

- Future scalability: The system architecture leaves room for adding more PV and storage

This use case highlights how modern hybrid battery solutions can replace legacy diesel generators in rural commercial settings where grid access is undesired, limited, or unreliable. Grocery stores are among the most demanding off-grid applications due to their continuous refrigeration loads and sensitivity to power outages. The combination of Discover’s storage, commercial hybrid inverters, and intelligent communication enables businesses like Springville Foods to operate independently without sacrificing reliability or customer service.

Key Takeaways for Future Projects

- Utility-grade performance at commercial scale: This project showcases how Discover Energy Systems is bridging the gap between industrial BESS solutions and commercial installer needs. By delivering utility-grade reliability, safety, and performance in a cost-effective, scalable package, Discover empowers C&I projects that were previously out of reach due to complexity or cost.

- Simple integration with hybrid inverters: Discover’s AES 210HV platform is purpose-built for compatibility with commercial hybrid inverters like the Sol-Ark 60K. Its plug-and-play DC and communication interfaces significantly reduce installation time, eliminate guesswork, and lower the barrier to entry for commercial solar installers entering energy storage.

- Standards-driven safety and resilience: UL 9540 Listed & UL 9540A Large Scale Fire Tested architecture, integrated aerosol fire suppression, passive deflagration venting, and a liquid thermal management system ensure that even demanding off-grid loads can be handled safely and dependably.

- System design matters: Pairing 418 kWh of usable storage with 120 kW of inverter capacity provided ample headroom for cold storage, air conditioning, and peak-hour loads. The system design ensures reduced generator runtime and flexible growth paths for future loads or PV expansion.

- Collaboration is critical: The success of this deployment is a testament to the alignment between technology providers, local installers, and technical distributors. CB Solar’s field execution, Zonna Energy’s system design expertise, and Discover’s product integration support combined to deliver a solution that exceeded customer expectations.

Installer and Partner Contributions

CB Solar of Gordonville, PA, played a central role in the success of this installation. With deep experience serving agricultural and commercial clients in Pennsylvania, the CB Solar team delivered a turnkey off-grid system that was expertly installed and commissioned to meet the unique needs of Springville Foods. Their familiarity with both rural power infrastructure and high-voltage storage integration allowed them to anticipate and mitigate challenges related to refrigeration loads and seasonal solar variability.

Equally vital was the contribution of Zonna Energy. As a specialized off-grid distributor with a long history of supporting battery-based projects across North America, Zonna provided detailed system design guidance and technical support throughout the planning and commissioning process. Their recommendation of the Discover AES 210HV platform was based not only on cost and performance but also on safety features, inverter compatibility, and long-term serviceability. Zonna’s ability to provide both logistics and hands-on guidance proved instrumental in ensuring this project met its ambitious energy goals without compromising reliability.

Interested in a Similar Solution?

Discover Energy Systems, CB Solar, and Zonna Energy are available to support off-grid and grid-independent projects across North America. If you are a business, farm, or institution exploring energy storage to eliminate or reduce diesel reliance, this project is a strong reference point for what’s possible today. Get in touch with us.

Remote Cabin in Northern Utah

Installer: Intermountain Wind and Solar

Project Overview

Set against the green farmland of Lancaster County, Springville Foods is now primarily powered by the sun and batteries. This image shows the store, PV array, and surrounding agricultural facilities that rely on resilient power.

Springville Foods is a full-service grocery store nestled in the heart of Pennsylvania Dutch country, serving a loyal base of Amish and rural customers since 2004. Like many businesses in remote or underserved areas, it historically depended on diesel generators to meet its energy needs, operating both a 100 kW primary and a 50 kW secondary generator. These units provided power to essential loads such as commercial coolers, freezers, HVAC, lighting, and point-of-sale systems. While reliable in principle, the diesel solution posed challenges: high fuel costs, regular maintenance requirements, and occasional load management limitations during peak usage.

In pursuit of sustainability, energy independence, and lower operating costs, the owners of Springville Foods partnered with CB Solar and Zonna Energy to transition to a modern hybrid power solution. The result is a clean, quiet, and efficient off-grid system powered primarily by solar and batteries, with diesel used only as a secondary backup.

Project Overview

CB Solar, Zonna, and Discover work on live commissioning of the AES 210HV cabinets and Sol-Ark 60K-3P inverters. Final performance checks on communication and closed-loop performance ensure a smooth transition to energy independence.

Discover’s AES 210HV high-voltage battery storage platform is the backbone of the new system. Two pre-assembled outdoor cabinets were installed, providing a total of 418 kWh of usable energy storage. These cabinets integrate seamlessly with two Sol-Ark 60K-3P commercial hybrid inverters, which deliver a combined 120 kW of continuous power output. A 75 kW photovoltaic array supplies renewable energy directly to the inverters and batteries.

The AES 210HV includes advanced thermal management via integrated liquid cooling and heating, built-in fire safety, thermal suppression (aerosol-based), and deflagration ventilation to meet UL9540 safety standards. Communication between the batteries and inverters is managed through the LYNK II Gateway, enabling real-time closed-loop control for optimized charging and discharging.

Key technical features of the system include:

- Storage Capacity: 418 kWh usable (two AES 210HV cabinets)

- Inverter Power: 120 kW continuous (two Sol-Ark 60K-3P inverters)

- Solar Capacity: 75 kW

- Grid Independence: Full off-grid operation with diesel generators now used only as backup

- Load Profile: Commercial refrigeration, HVAC, lighting, registers, and office equipment

Operational Benefits and Lessons for Off-Grid Designers

Two AES 210HV cabinets provide 418 kWh of high-voltage, liquid-cooled lithium storage. Prewired Sol-Ark inverters are wall-mounted next to the store's electrical room, allowing direct AC and DC integration.

.

Today, Springville Foods operates primarily on solar energy and battery power, with diesel backup used sparingly during extended cloudy periods or high-load events. The transition has delivered immediate benefits:

- Fuel savings: Dramatic reduction in diesel consumption and generator runtime

- Maintenance reduction: Fewer mechanical hours and service events for generator upkeep

- Quiet operation: A quieter, cleaner environment for staff and customers

- Load flexibility: Smoother delivery of power to compressors and HVAC systems, especially during peak load transitions

- Future scalability: The system architecture leaves room for adding more PV and storage

This use case highlights how modern hybrid battery solutions can replace legacy diesel generators in rural commercial settings where grid access is undesired, limited, or unreliable. Grocery stores are among the most demanding off-grid applications due to their continuous refrigeration loads and sensitivity to power outages. The combination of Discover’s storage, commercial hybrid inverters, and intelligent communication enables businesses like Springville Foods to operate independently without sacrificing reliability or customer service.

Key Takeaways for Future Projects

- Utility-grade performance at commercial scale: This project showcases how Discover Energy Systems is bridging the gap between industrial BESS solutions and commercial installer needs. By delivering utility-grade reliability, safety, and performance in a cost-effective, scalable package, Discover empowers C&I projects that were previously out of reach due to complexity or cost.

- Simple integration with hybrid inverters: Discover’s AES 210HV platform is purpose-built for compatibility with commercial hybrid inverters like the Sol-Ark 60K. Its plug-and-play DC and communication interfaces significantly reduce installation time, eliminate guesswork, and lower the barrier to entry for commercial solar installers entering energy storage.

- Standards-driven safety and resilience: UL 9540 Listed & UL 9540A Large Scale Fire Tested architecture, integrated aerosol fire suppression, passive deflagration venting, and a liquid thermal management system ensure that even demanding off-grid loads can be handled safely and dependably.

- System design matters: Pairing 418 kWh of usable storage with 120 kW of inverter capacity provided ample headroom for cold storage, air conditioning, and peak-hour loads. The system design ensures reduced generator runtime and flexible growth paths for future loads or PV expansion.

- Collaboration is critical: The success of this deployment is a testament to the alignment between technology providers, local installers, and technical distributors. CB Solar’s field execution, Zonna Energy’s system design expertise, and Discover’s product integration support combined to deliver a solution that exceeded customer expectations.

Installer and Partner Contributions

CB Solar of Gordonville, PA, played a central role in the success of this installation. With deep experience serving agricultural and commercial clients in Pennsylvania, the CB Solar team delivered a turnkey off-grid system that was expertly installed and commissioned to meet the unique needs of Springville Foods. Their familiarity with both rural power infrastructure and high-voltage storage integration allowed them to anticipate and mitigate challenges related to refrigeration loads and seasonal solar variability.

Equally vital was the contribution of Zonna Energy. As a specialized off-grid distributor with a long history of supporting battery-based projects across North America, Zonna provided detailed system design guidance and technical support throughout the planning and commissioning process. Their recommendation of the Discover AES 210HV platform was based not only on cost and performance but also on safety features, inverter compatibility, and long-term serviceability. Zonna’s ability to provide both logistics and hands-on guidance proved instrumental in ensuring this project met its ambitious energy goals without compromising reliability.

Interested in a Similar Solution?

Discover Energy Systems, CB Solar, and Zonna Energy are available to support off-grid and grid-independent projects across North America. If you are a business, farm, or institution exploring energy storage to eliminate or reduce diesel reliance, this project is a strong reference point for what’s possible today. Get in touch with us.

The Third Edition of UL 9540, published in June 2023, introduced long-needed clarity for Battery Energy Storage Systems (BESS). Adoption across North America has progressed at varying speeds as Authorities Having Jurisdiction (AHJs) work through interpretation, alignment with existing enforcement practices, and integration into local approval processes. In Canada, the standard was incorporated into the 2024 Canadian Electrical Code (CEC, Part I), formally recognizing both AC- and DC-coupled ESS architectures. However, as with many newly adopted codes, consistent application at the local level has taken time, and differing interpretations among AHJs across America have contributed to extended review cycles and uncertainty for installers into 2025/26.

What Changed in UL9540 Third Edition?

The most important update was simple but impactful: UL9540 now distinguishes between AC ESS and DC ESS.

- AC ESS: A battery paired with an integrated inverter, certified as one unit.

- DC ESS: A standalone battery system certified to UL9540, designed to pair with a compatible, separately listed inverter.

Both system types are now evaluated to the same safety requirements, including UL9540A fire testing, system-level protections, and performance validation. The primary difference is how the Power Conversion Equipment (PCE) is documented: AC ESS includes the inverter within its certification, DC ESS verifies inverter/battery compatibility through manufacturer documentation. All the safety tests between AC ESS and DC ESS are identical.

This shift enables modern DC battery systems to be certified as UL9540 DC ESS, which offers flexibility in pairing with UL 1741 or CSA 107.1-listed inverters, rather than requiring fixed, pre-engineered packages.

The following table compares AC ESS with DC ESS.

| Item | AC ESS | DC ESS |

|---|---|---|

| PCE Integration | Included as part of the ESS certification and evaluated to UL 1741 or UL 62109-1 | Evaluated separately under UL 1741 or UL 62109-1 as standalone or multi-mode power conversion equipment |

| Certification Scope | ESS includes the inverter and battery as one integrated product | ESS functions as a standalone DC system compatible with multiple PCE |

| Compatibility Documentation | Fixed configuration, each pair included a specific inverter and battery | Managed by the manufacturer per UL 9540 Clause 46.14 |

| Safety Evaluation | UL 9540A fire testing and system-level protection | UL 9540A fire testing and system-level protection (identical evaluation as AC ESS) |

UL9540 in the Electrical Code

The UL9540 DC ESS fits into the National and Canadian Electrical Code (CEC) as published in the UL9540 Third Edition, as shown below.

| Component | Required Certification | Role |

|---|---|---|

| 1. Battery System | UL 9540 (Listed as “DC ESS”) | UL 9540 certifies the battery pack, BMS, and protection as a safe standalone system. |

| 2. Inverter | UL 1741 or CSA C22.2 No. 107.1 | The UL or CSA listing certifies the inverter’s safety and grid interaction capabilities. |

| 3. Interoperability | Manufacturer Manual / Closed-Loop Integration | The battery’s UL 9540 manual lists the specific inverter brand/model as compatible, or defines the integration settings. |

Why Many AHJs Aren’t Aligned

The challenge is largely interpretive, not technical. The disconnect between the national governing bodies and many parts of North America may be due to a misalignment in the mindset of both inspectors and system designers.

- First and Second Edition:

ESS = battery + inverter. Tested and certified as a single unit - Third Edition:

DC ESS = standalone battery system + separately certified inverter. Battery and inverter are tested and certified separately

Of all the components in a solar energy system, only the battery and inverter required being tested as a single unit. None of the other components was restricted in this way. Whether it be solar panels, junction boxes, DC disconnects, AC distribution panels, and so on, each component serves a particular purpose and is tested to ensure it operates as defined, in a safe and controlled manner. However, the UL listing for these components is not determined by their pairing with another component. That would be restrictive. Compliance is not, and should not, be contingent on connecting to a specific device, which was the case for batteries and inverters in the first and second editions of UL9540.

UL 9540 Third Edition addresses this issue by decoupling the inverter and battery. UL 9540 ensures safe operation by testing the safety and functional operation of the DC ESS components, including the BMS and control logic, thermal protection, electrical safety, and system integration. The boundaries of the DC ESS are firmly defined, allowing installers and AHJs to concentrate on other aspects of the installation, such as the installation environment, component spacing, and connection methods.

This shift in what to inspect in a UL 9540 Third Edition energy storage system requires training. The lack of understanding of the new regulations has resulted in varying timelines for adoption across North America, leading to inconsistent enforcement and frequent project delays. We look forward to everyone involved gaining a better understanding of the new regulations in 2026 and to increased adoption of best practices.

Verification Checklist for AHJs

To approve a DC ESS installation under UL9540 Third Edition, AHJs can follow a simple checklist:

- Verify UL9540 listing for the battery system.

- Review UL9540A test data for spacing and fire safety requirements.

- Confirm inverter certification (UL1741 or CSA 107.1).

- Check manufacturer compatibility documentation (per Clause 46.14 in the UL9540 standard).

- Ensure installation follows the battery manufacturer’s instructions.

This ensures that the battery and inverter are individually compliant and safe as a combined system.

Supporting Documentation from Discover Energy Systems

Discover Energy Systems provides integration guides and LYNK II Gateway documentation listing validated inverter models. The HELIOS ESS manual also lists inverter brands that are supported through its native communication protocol settings. These resources help AHJs verify compatibility and provide instructions that enable proper communication between the ESS and the inverter.

Conclusion

UL 9540 Third Edition represents a significant step forward in modernizing energy storage safety for both integrated AC systems and modular DC systems. The Third Edition offers increased safety and flexibility while maintaining protection requirements for all types of energy storage systems.

The full benefit of the new standard will be realized when AHJs fully understand and apply the new framework. As inspectors transition from fixed, pre-engineered systems to modular DC ESS paired with certified inverters, consistent training and documentation become essential. With guidance and manufacturer-supported compatibility tools, jurisdictions across North America can confidently approve safe, flexible, and future-ready energy storage installations, unlocking the full value of the UL9540 Third Edition.

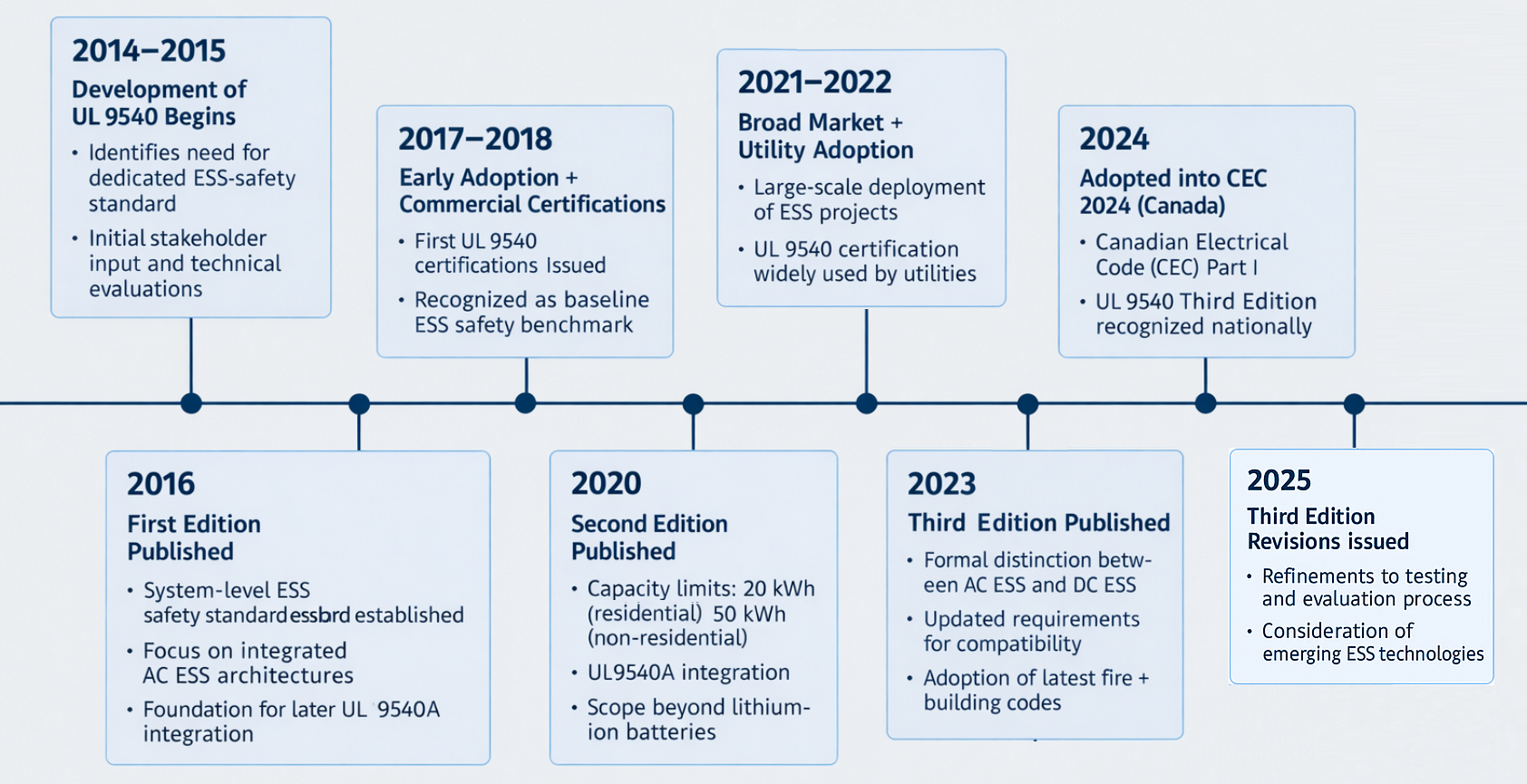

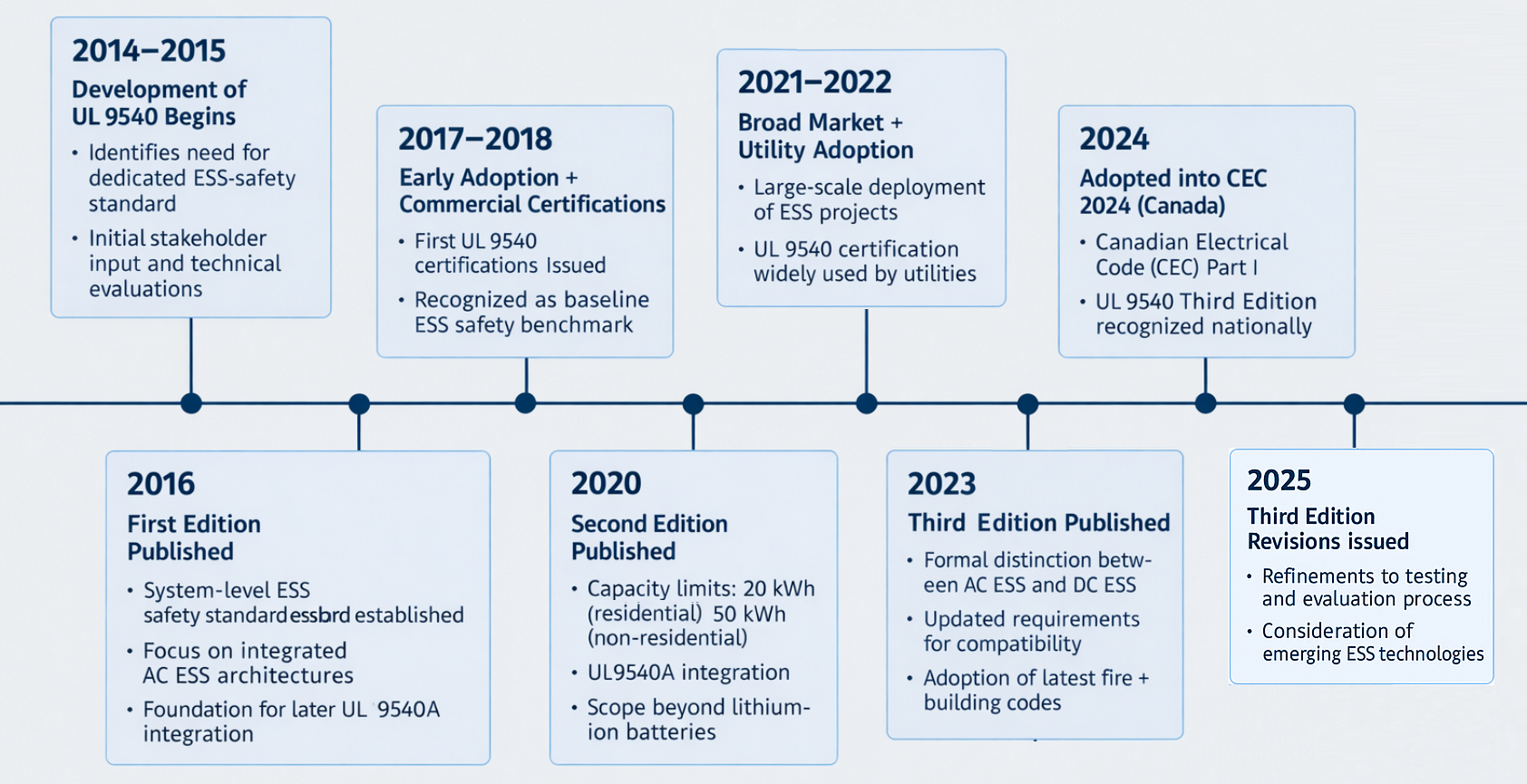

UL 9540 from 2016 to Today:

How a Young Standard Reshaped Energy Storage Safety

INTRODUCTION

In less than a decade, UL 9540: Standard for Energy Storage Systems and Equipment has gone from a brand-new concept to the de facto standard for commercial and residential battery energy storage in North America. First published in 2016, the standard has gone through three major editions, each one responding to rapid changes in technology, fire-safety knowledge, and installation codes such as NFPA 855.

UL 9540 has changed how manufacturers operate, as well as how Authorities Having Jurisdiction (AHJs), fire officials, and electrical inspectors evaluate projects. UL9540 defines what to look for on drawings, what documentation reviewers should expect in permitting applications, and how comfortable inspectors feel when they approve systems that can store tens, hundreds, or thousands of kilowatt-hours of energy in one place.

This topic traces UL 9540’s evolution from its First Edition (2016), through the Second Edition (2020), and into the Third Edition (2023, with 2025 revisions), highlighting:

- The key regulatory and safety requirements in each edition

- How each version improved on the previous one

- The practical impact on AHJs and inspectors

Development of UL9540

UL9540 was developed in response to emerging safety concerns, the rapid evolution of lithium battery technology, and the need for system-level certification that extended beyond simply testing individual components.

Two major factors drove the development UL9540:

- Emerging lithium-based energy storage

- Increasing numbers of fires and safety incidents

The Rise of Lithium-Based Energy Storage (2010–2014)

In the early 2010s, lithium-ion batteries began moving from consumer electronics into:

- Residential solar + storage systems

- Commercial backup power

- Utility-scale energy storage projects

Before UL 9540 existed, the standards were:

- UL 1973 → stationary battery modules (component-level)

- UL 1741 → inverters and power conversion equipment

- UL 9540A (in development) → fire-propagation test method

However, there was no standard evaluating an ESS as a complete, integrated system, including the battery, BMS, inverter interactions, enclosure, wiring, thermal management, and safety controls. This gap became unacceptable as systems increased in size and energy density.

Early Fires and Safety Incidents

Between 2011 and 2014, several ESS fire events in the U.S. and elsewhere raised urgent safety concerns. Investigators found that the problem was not just the battery cells, but the interaction of the entire system (thermal runaway propagation, enclosure behavior, protection logic, charging controls, and so on) that contributed to the fire.

This insight prompted regulators and standards developers to recognize that component-level certification was insufficient for an ESS.

EARLY UL DEVELOPMENT

UL Begins Developing a System-Level ESS Standard (2014–2015)

Recognizing the need for a unified evaluation method, Underwriters Laboratories initiated the development of a new standard focused on:

- Overall system safety

- Fire and electrical hazards

- Thermal management

- Communication between components

- Installation and operational behavior

During this period, UL worked closely with:

- ESS manufacturers

- Battery chemistry experts

- Fire protection engineers

- NFPA and IFC technical committees

- Utilities and AHJs

Stakeholder meetings, technical workshops, and draft reviews led to the development of the first framework, which ultimately became UL 9540.

Integration with UL 9540A (Fire Propagation Testing)

At the same time, UL began developing UL 9540A, a large-scale fire test designed to measure:

- Thermal runaway onset

- Propagation behavior

- Off-gas production

- Flame and heat release characteristics

Although UL 9540A was published separately, it became an essential input to UL 9540 system certification and later to NFPA 855 and the International Fire Code.

This co-development was a significant aspect of UL 9540’s development.

UL 9540 FIRST EDITION (2016)

In 2016, UL officially released:

- UL 9540 – Standard for Energy Storage Systems and Equipment (First Edition)

The first edition provided:

- A system-level safety framework

- Requirements for integrated AC ESS

- Evaluation of the BMS + battery + PCS as a unified product

- Mechanical, electrical, and environmental tests

- Basic enclosure and thermal safety criteria

This publication marked the first time manufacturers could receive ESS-level certification, not just component listings.

When UL 9540 was first introduced in late 2016, the codes and standards were fragmented.

- Batteries were covered by UL 1973

- Inverters were covered by UL 1741

UL 9540 was the first system-level standard that tied the pieces together. Manufacturers could receive ESS-level certification, not just component listings. The First Edition (ANSI/CAN/UL 9540:2016) defined requirements for energy storage systems intended to receive electric energy and store it for later use, covering both stationary and mobile, and indoor and outdoor systems.

Key elements:

- System-level safety: Safety related to enclosures, controls, interconnections, and thermal management, as well as requirements for integrated AC ESS.

- Electrical performance testing: Verifying ratings, abnormal operation, short-circuit behavior, and protective functions, as well as evaluation of the BMS + battery + PCS as a unified product.

- Mechanical and environmental tests: Vibration, impact, ingress protection, temperature/humidity cycling, and basic enclosure and thermal safety criteria.

- Product markings and instructions: Labels, installation manuals, and warnings.

Most early UL 9540 listings were integrated systems. A battery paired with a specific inverter and controls, evaluated as one self-contained ESS. UL’s first UL 9540 certification was issued to an Enphase home energy storage system in 2016, which illustrates this “fixed pairing” approach.

Relationship with AHJs and Inspectors

For AHJs and inspectors, the UL9540 First Edition simplified their job.

- It provided them with a single system-level listing to search for, eliminating the need to piece together battery, inverter, and BMS compliance manually.

- It aligned with emerging NEC requirements that ESS units be certified to a recognized standard.

Limitations

However, several limitations quickly emerged:

- UL 9540 First Edition predated NFPA 855, so it was not integrated with installation rules being drafted for large battery systems.

- The first edition assumed relatively modest system sizes and simpler, integrated architectures. Grid-scale projects, modular cabinets, and DC-coupled solar-plus-storage systems emerged rapidly and were not fully anticipated.

The UL 9540 First Edition gave AHJs a binary check (“Is it UL 9540-listed?”), but it did not provide the tools required to manage complex ESS sites, spacing, and fire protection. That gap would drive the next revision.

UL 9540 SECOND EDITION (2020)

Aligning NFPA 855 and UL 9540A

UL9540 Second Edition was published on February 27, 2020.

By 2019, several trends had emerged.

- High-profile ESS fires made thermal runaway and fire propagation a top concern.

- NFPA 855, the installation standard for stationary ESS, was finalized in 2020. NFPA included requirements for UL 9540 listing and UL 9540A fire testing.

- Larger, containerized systems and commercial/utility-scale deployments had become common.

The Second Edition explicitly addressed these concerns.

Technical and Safety Enhancements

- Closer integration with UL 9540A

- Large-scale fire testing (UL 9540A) became central to determining spacing, enclosure design, and maximum allowed capacity per unit.

- Manufacturers had to bring UL 9540A data into their UL 9540 reports and installation manuals, making fire-propagation performance part of the listing.

- Metallic enclosures and physical protection

- For many larger systems, metallic enclosures and enhanced construction were required to contain potential fires and protect against mechanical damage.

- Expanded system categories and applications

- More precise requirements for indoor vs. outdoor, residential vs. non-residential, and mobile vs. stationary ESS.

- Additional documentation requirements

- Manuals had to specify maximum system capacity, required spacing, and installation limitations derived from UL 9540A testing and NFPA 855 tables.

The Second Edition turned UL 9540 into a bridge between product certification and installation codes.

Improvements

Differences between the First Edition and the Second Edition:

- Fire-propagation behavior is a core safety attribute, not an afterthought.

- Performance-based data. UL9540A test results and spacing between equipment enhanced decision-making. Separation distances and room layouts were now based on test results rather than guesswork.

- Addressed large containerized systems, which had become common in utility and C&I markets.

Impact on AHJs and Inspectors

For AHJs, the Second Edition brought both clarity and complexity:

- Clarity

Because NFPA 855 explicitly required ESS units to be listed to UL 9540 and tested to UL 9540A, UL 9540 became the accepted “stamp of approval” for system-level safety. - Complexity

Inspectors now had to:- Read and interpret UL9540A test summaries

- Verify installation spacing with the manufacturer’s UL-based tables

- Understand that the UL9540A performance results may result in different spacing requirements for different systems.

Some AHJs quickly adopted checklists to align UL 9540 listings with NFPA 855 placement rules, while others struggled with the learning curve, especially when training and resources were limited.

THIRD EDITION (2023–2025)

AC ESS, DC ESS, and Functional Safety

By the early 2020s, the technology landscape shifted again:

- DC-coupled solar + storage and flexible “DC ESS + separate inverter” architectures exploded in popularity.

- ESS projects grew in scale and complexity, with a variety of chemistries.

- Codes like NFPA 855 and the International Fire Code were updated, further integrating UL 9540A as the preferred fire test method.

The Third Edition of ANSI/CAN/UL 9540, issued on June 28, 2023, was designed to “keep pace with rapidly advancing technology” and better align with installation codes.

New Concepts and Safety Requirements

- Formal distinction between AC ESS and DC ESS

- AC ESS: integrated systems that include the inverter as part of the ESS listing.

- DC ESS: systems that output DC power and are designed to connect to separately listed power-conversion equipment (PCE), such as UL 1741 or UL 62109-1 inverters.

- Both AC and DC ESS are evaluated under the same safety framework, including UL 9540A-based fire testing and system-level protections.

- Alignment with NFPA 855 and fire codes

- Clarified capacity and separation limits based on UL 9540A results to match NFPA 855 and fire codes.

- Include explosion control requirements when applicable.

- External warning and communication systems

- New criteria for early warning and remote notification of potential ESS safety issues, to improve situational awareness for operators and first responders.

- Expanded environmental, noise, and fluid-hazard requirements

- Requirements for noise levels, coolant behavior (including “direct injection” systems), and management of hazardous fluids.

- Functional safety and multi-part systems

- 2025 revisions to the Third Edition add functional safety requirements and clarify markings and documentation for multi-part ESS, along with guidance in Annex H for residential installation instructions.

Third Edition Improvements

There are several improvements to the Third Edition, compared to the Second Edition.

- AC vs. DC ESS clarity

- The Second Edition treated ESS as a single category, heavily biased toward integrated AC systems.

- The Third Edition explicitly recognizes standalone DC ESS as a valid configuration, making it easier to certify modular DC batteries intended to work with multiple inverter platforms.

- Better alignment with modern codes

- NFPA 855 and the 2024 IFC now reference UL 9540A as the preferred fire-test method. The Third Edition clarifies how UL 9540A data determines spacing and capacity limits.

- More comprehensive risk coverage

- New requirements around explosion control, external warning systems, noise, and fluid hazards extend the standard beyond electrical and thermal tests into a holistic view of ESS risk.

The Third Edition transforms UL 9540 from a “one-size fits all” ESS listing into a flexible framework that can handle integrated AC systems, modular DC battery cabinets, and future hybrid architectures, while still imposing a common safety baseline.

AHJs and Inspectors (Third Edition)

The AC/DC distinction and modular DC ESS approach have had mixed impacts on AHJs:

- Benefits

- For integrated AC ESS, the Third Edition continues the familiar model: one UL 9540 listing that covers the battery, inverter, and controls. Inspectors can treat it as a single appliance.

- For DC ESS, the standard explicitly defines compatibility documentation requirements under clauses like 46.14, requiring manufacturers to maintain lists or parameters of compatible PCE. This gives AHJs a formal paper trail to review.

- Challenges

- AHJs must now evaluate two separate listings: 1) DC ESS (UL 9540) and 2) Inverter (UL 1741 / UL 62109-1).

Based on these two listings, the AHJ must verify that the pairing is documented as compatible in the manufacturer’s manuals. - Some inspectors, especially in jurisdictions new to ESS, have struggled with this more nuanced model, initially viewing “UL 9540 DC ESS + UL 1741 inverter” as a loophole rather than an intended evolution.

- AHJs must now evaluate two separate listings: 1) DC ESS (UL 9540) and 2) Inverter (UL 1741 / UL 62109-1).

Even in Canada, where the Third Edition has been incorporated as an ANSI/CAN standard and referenced in the 2024 Canadian Electrical Code, many AHJs are slow to recognize DC ESS listings and modular pairings, continuing to expect fixed AC ESS packages.

SUMMARY

The table below summarizes the three editions.

| First Edition (2016) | Second Edition (2020) | Third Edition (2023/2025) | |

|---|---|---|---|

| Focus | Establish a system-level safety standard for ESS. | Align with NFPA 855 and address lessons from ESS incidents. | Keep pace with advanced architectures and modern codes. Clarify AC vs. DC ESS. Add functional safety. |

| Architecture | Integrated AC ESS; battery + inverter listed as one system. | More robust treatment of larger, modular systems, but still conceptually ESS as a single, integrated category. | Explicit AC ESS vs. DC ESS classification. Support flexible DC ESS paired with separately listed PCE. |

| Safety Features | Basic electrical, mechanical, environmental, and functional safety tests. Limited integration with fire-propagation data. | Tight integration of UL 9540A fire testing, metallic enclosures for many systems, explicit documentation of capacity and spacing limits in manuals. | Clarified capacity/separation rules tied to UL 9540A and NFPA 855, explosion control, external warning systems, noise and fluid-hazard requirements, updated markings and instructions (Annex H). |

| AHJ Impact | Introduced a clear “UL 9540–listed ESS” concept, simplifying approvals for early residential and small C&I systems. | Provided performance-based tools (UL 9540A data and manufacturer spacing tables) but required more technical literacy from inspectors; increased confidence for large ESS at the cost of added complexity. | Consistent treatment of integrated AC ESS and modular DC ESS under a single safety framework. Requires careful review of both battery and inverter listings along with documentation to confirm compatibility. |

CONCLUSION

UL 9540 has evolved in lockstep with the battery energy storage industry.

- The First Edition answered a basic need for system-level safety certification, giving AHJs and installers a common reference point for early residential and C&I ESS.

- The Second Edition integrated fire-propagation testing and NFPA 855 into the standard, shifting the focus from component safety to installation-relevant performance, especially for large, containerized systems.

- The Third Edition, with its explicit AC/DC ESS framework and expanded functional-safety and communication requirements, recognizes that modern ESS may be modular, DC-coupled, and heavily software-driven while still needing a consistent safety baseline across all architectures.

Each edition has raised the profile of AHJs and inspectors.

- First Edition: Is it UL 9540-listed?

- Second Edition: Does the UL 9540A data and spacing comply with NFPA 855?

- Third Edition: Is the ESS UL 9540 (AC or DC)? Is the PCE UL-listed? Does the manufacturer’s documentation identify equipment as compatible? Does the installation match the test parameters?

As of 2025, UL 9540 is deeply embedded in North American regulations, referenced by NFPA 855, the International Fire Code, utility standards, and national electrical codes in both the United States and Canada. As energy storage technology continues to evolve, expect UL 9540 to continue to evolve with it.

Solar panels and battery storage deliver lower electricity bills, energy resilience, and long-term independence from rising utility rates. But every homeowner faces one major question: Should you buy your solar + storage system, or lease it from a third party?

On the surface, leasing seems attractive. There is low or no upfront cost, maintenance is included, and you get immediate bill savings. However, buying gives you ownership, access to rebates, and greater lifetime savings. When installing Discover Energy Systems’ HELIOS ESS lithium battery, which has the lowest-cost-per-kWh storage solution in its class, the financial advantage of ownership is more apparent than ever.

The following illustrates the costs and benefits of buying vs. leasing solar + storage.

(This article will look at the leasing option only in third-party ownership systems. We will not examine the other third-party option, the power purchase agreement.)

Buying Solar + Storage with HELIOS ESS

Purchasing your solar + storage system means you own the equipment and all the value it produces. Rebates, tax credits, and bill savings flow directly to you—not a leasing company. With Discover’s HELIOS ESS, buyers get a scalable, high-performance battery at the best price per kWh on the market, maximizing both incentives and ROI.

Typical Costs (10 kW solar + 32 kWh HELIOS ESS battery)

|

Item |

Cost (USD) |

|---|---|

|

Solar panels (10 kW @ $1/W) |

$10,000 |

|

2 x HELIOS ESS (32 kWh @ $225/kWh) |

$7,200 |

|

Inverter, wiring, and peripheral equipment |

$8,000 |

|

Installation & labor |

$7,000 |

|

Gross system cost |

$32,200 |

|

Federal ITC (30%) expires 12/2025 |

-$15,000 |

|

Local rebates (varies depending on region) |

-$5,000 |

|

Net cost to owner |

$12,200 |

NOTE: If the cost of electricity in your area is $2000 per year, the system pays for itself in about 6 years.

Financing Solar + Storage

Most people do not have the cash to purchase their solar + storage system. They will take out a loan to finance the purchase. Financing will give you all the benefits of buying, but it will add an extra cost to fund the loan.

Typical Costs (10 kW solar + 32 kWh HELIOS ESS battery + Loan)

|

Item |

Cost (USD) |

|---|---|

|

Solar panels (10 kW @ $1/W) |

$10,000 |

|

2 x HELIOS ESS (32 kWh @ $225/kWh) |

$7,200 |

|

Inverter, wiring, and peripheral equipment |

$8,000 |

|

Installation & labor |

$7,000 |

|

Gross system cost |

$32,200 |

|

Federal ITC (30%) expires 12/2025 |

-$15,000 |

|

Local rebates (varies depending on region) |

-$5,000 |

|

Loan Amount |

$12,200 |

|

Financing Cost (8%) |

$2,652 |

|

Monthly Payment (4 years) |

$310 |

|

Net cost to owner |

$14,852 |

NOTE: If the cost of electricity in your area is $2,000 per year, the system pays for itself in about 7.5 years.

Leasing Solar + Storage

Leasing eliminates upfront costs. You pay a fixed monthly fee while the leasing company owns the system, collects incentives, and maintains it. You benefit from bill savings, but without ownership, the leased solar + storage will provide zero, or even negative, resale value.

Typical Lease Terms (same 10 kW + 32 kWh system)

|

Item |

Cost (USD) |

|---|---|

|

Upfront payment |

$0 – $1,000 |

|

Monthly lease payment |

$250 – $300 |

|

Lease term |

20 years |

|

Annual cost ($250 × 12) |

$3,000 |

|

Total lease payments |

$60,000 |

|

Ownership at end of term |

No (option to renew or buy at fair market value) |

NOTE:

- You cannot select the desired equipment in a leased system. The solar leasing company determines the installed equipment.

- When it comes to maintenance, you are dependent on the leasing company. If the system goes down and it takes a week to restore, the homeowner must pay for power from the utility during that time and is not reimbursed for this additional expense.

Pros and Cons

The following table lists the pros and cons between purchasing, financing, and leasing your solar + storage system.

|

Category |

Buying System with HELIOS ESS |

Financing System with HELIOS ESS |

Leasing System (any equipment) |

|

Electric bill savings |

PRO |

PRO |

PRO |

|

Rebates & incentives |

PRO |

PRO |

CON |

|

Financing cost |

PRO |

CON |

CON |

|

Maintenance |

CON |

CON |

PRO |

|

Resale value |

PRO |

PRO |

CON |

|

System ownership |

PRO |

PRO |

CON |

Lifetime Financial Comparison (20 Years)

|

Metric |

Buying System |

Financing System |

Leasing System |

|

S |

$12,200 |

14,852 |

$60,000 |

|

Total bill savings (20 yrs) |

$40,000 (2,000/yr) |

$40,000 (2,000/yr) | $40,000 (2,000/yr) |

|

Rebates & ITC benefit |

$20,000 |

$20,000 |

$0 |

|

Maintenance (20 yrs) |

($6,000) |

($6,000) |

$0 |

|

Net 20-year |

$21,800 |

$19,148 |

($20,000) |

Over a period of 20 years, leasing the system costs much more than the savings you can achieve on your utility bill.

If you buy or finance the system, with rebates and utility bill savings, the system pays for itself within 6 to 8 years and nets you $20,000 in the long run.

HELIOS ESS Makes Buying Even Better

By purchasing your solar + storage system, you have a choice on what equipment to install. You don’t have to accept any system; you can ask to use the HELIOS ESS.

Discover’s HELIOS ESS isn’t just another battery—it’s engineered for value and performance:

- Lowest $/kWh on the market, stretching every rebate dollar.

- Modular, scalable design to grow with your needs.

- Long cycle life and high efficiency for better performance.

- Seamless integration with leading hybrid inverters.

Buying a HELIOS ESS system is the clear choice when you combine these advantages.

Conclusion

Leasing may sound appealing because it reduces upfront costs, but dollar for dollar, it leaves you paying significantly more over time with nothing to show for it. Buying a solar + storage system based around Discover’s HELIOS ESS ensures you get every incentive, maximize long-term savings, and add real value to your property.

If you’re serious about energy independence and financial return, buying a HELIOS ESS solar + storage system is the smarter investment.

For more information on the HELIOS ESS, click here.